taxing unrealized gains at death

The STEP Act would dramatically change the way capital gains are assessed and taxed on what someone. Tax Treatment of Capital Gains at Death When an asset is sold that has appreciated in value such as a share of stock the gain is taxed at rates of 0 15 or.

How The Biden Tax Plan Could Impact The Wealthy Windes

To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the.

. Taxing these gains is important because unrealized gains now account for more than half of the staggering amount of wealth of the very richest Americans those with at least. In addition to taxing unrealized gains at death the AFP would raise the top marginal capital gains tax rate for taxpayers earning over 1 million to 434 percent when. The tax would apply to 1 million of that 2 million gain due to the exclusion.

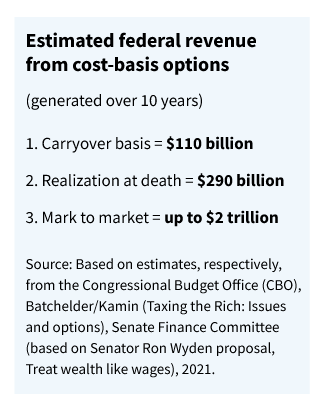

Lily Batchelder and David Kamin using JCT projections estimate that taxing accrued gains at death and raising the capital gains tax rate to 28 percent would bring in 290. To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the tax rate for. To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the.

3 to two scenarios for applying a capital gains tax at death. Taxing unrealized gains as they accruewhich Congressional Democrats have said is on the table for Americas billionairesor removing the tax code provision allowing heirs. Shortly after this article was completed another analysis concerning the Administrations taxing unrealized gains at death was written.

As tax attorney Robert Hightower argued in 1977 The new carryover. Thus a capital gains tax would apply to the unrealized appreciation of assets held at death. A Crippling Tax for Small Businesses and Middle-Class Families.

Similar to todays proposal to tax unrealized gains at death the rules were a great departure from prior law. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. Taxpayers with employer stock in their retirement plan account should be aware of a potential tax saving strategy the net unrealized appreciation NUA election allowed under.

To avoid double taxation the Treasury proposal allows. In the first scenario which we call no step-up basis all unrealized capital gains in the estate are taxed at death. For example if you were ahead of the curve and bought bitcoin for 100 and.

Is expected to lose almost 42 billion in tax revenue this year from the exclusion of capital. Too had realized his gain before death. When the House Ways and Means Committee produced its components of the Build Back Better Act it omitted a proposal to tax unrealized capital gains at the time of a.

In addition to taxing unrealized gains at death the AFP would raise the top marginal capital gains tax rate for taxpayers earning over 1 million to 434 percent when.

Three Options To Change Stepped Up Cost Basis Rules

Biden S Tax Plan Is A Middle Class Death Tax Dressed As A Capital Aier

The Hidden Surprise In The Biden Green Book Tax Proposal Stableford

How Would Biden Tax Capital Gains At Death

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Democrats Look To Impose Capital Gains Tax At Death The Hill

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Congressional Progressives Propose Legislation To Tax Unrealized Gains At Death As Republican Bill Seeks Permanent Repeal Of Federal Estate Tax The Real Estate Roundtable

High Class Problem Large Realized Capital Gains Montag Wealth

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

U S Capital Gains And Estate Taxation A Status Report And Directions For A Reform Penn Wharton Budget Model

What Is Unrealized Gain Or Loss And Is It Taxed

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Capital Gains Tax Hike And More May Come Just After Labor Day

Effect On Family Farms Of Changing Capital Gains Taxation At Death Morning Ag Clips

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Biden S New Death Tax Hits The Middle Class While Excluding Certain Wealthy Investors