philadelphia wage tax rate

The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. Your first filing due.

2020 Pennsylvania Payroll Tax Rates Abacus Payroll

For specific deadlines see important dates below.

. But for the 2023 fiscal year the City of Philadelphia is reducing that tax rate to the lowest its been in five decades. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate. Effective July 1 2021 the rate for.

Effective July 1 2022 the Philadelphia City Wage Tax will decrease for both residents and non-residents. Each year the Department of Revenue publishes a schedule of specific due dates for the Wage Tax. The new NPT and SIT rates are applicable to income earned in Tax Year 2022 for returns due and.

On Thursday Philadelphia City Council voted to reduce wage. See below to determine your filing frequency. Here are the new rates.

The Earnings Tax closely resembles the. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non. Quarterly plus an annual reconciliation.

The taxpayer also paid city wage tax at the 392 resident rate and claimed a credit for Wilmington EIT paid imposed at a 125 rate. Wage Tax for Residents of Philadelphia. Here are the new rates.

Earnings Tax employees Due date. The nonresident Earnings Tax rates in Philadelphia Pennsylvania will be reduced starting on. Resolve bills or liens for work done by the City on a property.

The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. The wage tax rate is set to drop from 384 to 379 for resident city workers. The nonresident Earnings Tax rates in Philadelphia Pennsylvania will be reduced starting on July 1 2021.

2022-2023 Philadelphia City Wage Tax Rate. Based on the average median household income in. The wage tax rate is set to drop from 384 to 379 for city workers and the median annual household income for Philadelphia is about 49k.

All Philadelphia residents owe the City Wage Tax regardless of where they work. The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees paychecks. The Earnings Tax rates in the new fiscal year are therefore 38712 038712 for residents and 35019 035019 for non-residents.

What is Philadelphia income tax rate. Resolve business and incomeWage Tax liens and judgments. For residents and 344 for non.

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the. Non-residents who work in Philadelphia must also pay the Wage Tax. With that household income.

2 Zilka then claimed a credit for the. Here are the new rates. Do I have to include Philadelphia City Wage Tax on my New Jersey tax return.

Use code enforcement numbers to request a payoff. Non-residents who work in Philadelphia must also pay the Wage Tax. What Is Philadelphia City Wage Tax.

379 0379 Wage Tax. The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. Tax rate for nonresidents who work in Philadelphia.

Changes to the Wage and Earnings tax rates become effective July 1 2022.

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Philly Eyes Cuts To City Wage Tax Business Tax Rate Whyy

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Economy League Philadelphia Budget Analysis

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Philadelphia Wage Tax Cut What Does It Mean For Workers On Top Of Philly News

Montgomery County Says Enough To Philadelphia Wage Tax

Philadelphia Tax Rate Updates As Of July 1 Abacus Payroll

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

The Tax Warrior Chronicles Philadelphia Wage Tax

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia

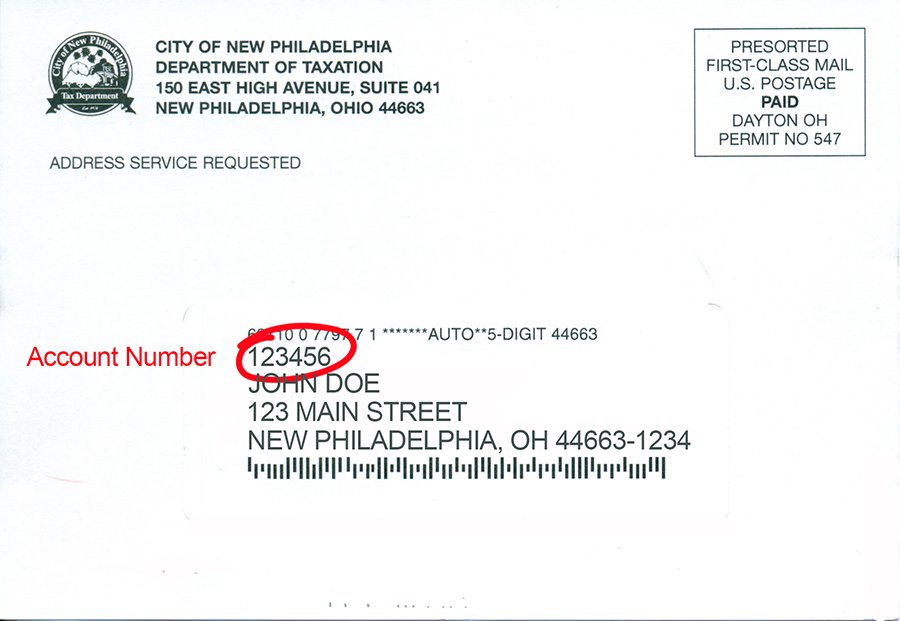

City Of New Philadelphia Income Tax Department

Philadelphia Wage Tax Reduced Beginning July 1 Department Of Revenue City Of Philadelphia

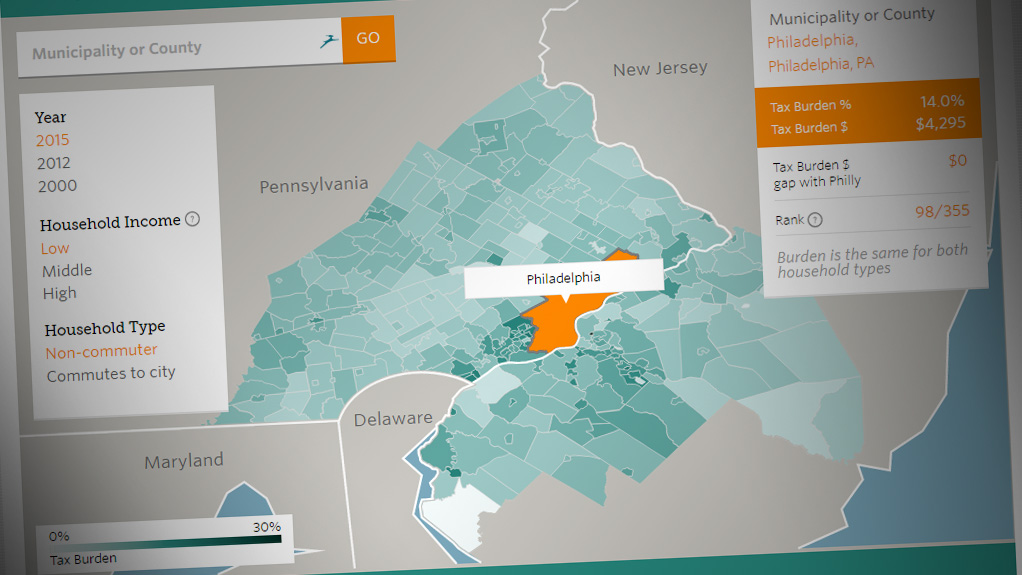

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts